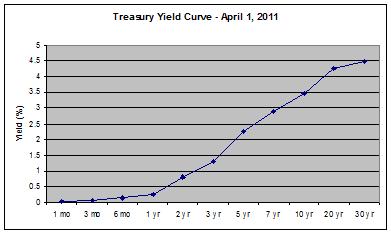

Yields on Treasury notes and bonds rose on Friday as investors reacted to better than expected employment figures. The rise in yields dropped bond prices. But as the charts below show, the moves are hardly anything to get excited about.

I love the headlines from the major busines pubs. Treasuries Tumble as Economy Loses Fewer Jobs Than Forecast, writes Bloomberg. Well, tumble is a relative term and since they don't include any historical data it's hard to know what tumble means. So, I decided to take a look.

I couldn't quickly find historical Treasury bond or note prices so I've used yield as a proxy. Treasury prices move inversely to Treasury yield, so if yield is moving up, prices are moving down, and vice-versa.

Here's what Treasury yields have done since January 1, 2010:

There's a bit of a spike today and over the last couple of days but it's really not much compared to the past three months. We've seen similar spikes of an equal or greater magnitude.

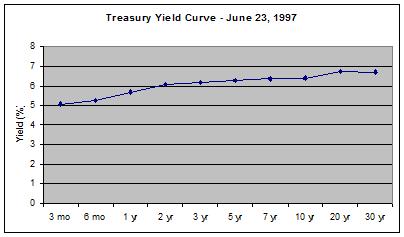

Now, let's take a step back and look at 2-year Treasury Note yields over the long-term:

It makes the blips of the last couple of days and even months look insignificant. Looking at this chart, it's hard to say that Treasuries are doing anything significant. If anything, the long-term trend is down and there's nothing to indicate any large increase in rates anytime soon.

Add your Comment

or use your BestCashCow account